Monetary policy is set to become less supportive in 2022. Here’s what it means for rates and the yield curve.

Three hikes in 2022?

At its December meeting, the US Federal Reserve left policy

rates unchanged, near zero, while signaling a willingness to

hike as many as three times in 2022 to combat inflation.

It also announced an acceleration in the pace of the taper

that could see the asset purchase program end by March.

Once this occurs, the Fed expects to begin raising rates,

with an additional three increases penciled in for 2023

and two more in 2024. This would bring the Fed Funds rate

close to its estimated neutral level, where monetary policy

is neither easy nor tight, of 2.5%.

Surprises are possible, so avoid making big bets on long-duration assets

The direction of long-term Treasury yields depends on how

the Fed responds to current inflation. The Fed is accelerating

its removal of liquidity because inflation has broadened,

which has the potential to push 10-year yields higher. But it

must be careful not to act too aggressively, which could derail

the economic recovery and cause a recession. We think

remaining flexible and willing to adjust duration as the year

progresses is the best course of action.

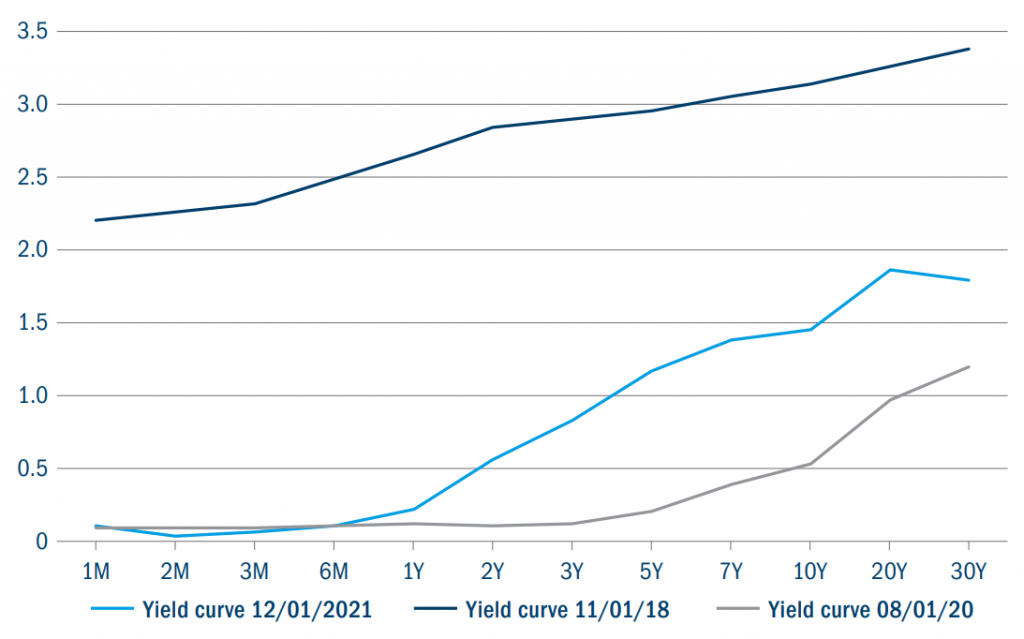

Figure 1: Rates are up from Covid lows, but are unlikely to reach pre-pandemic highs

Source: Bloomberg, December 2021.

Traditional inflation hedges are expensive

Many of the traditional inflation hedges, including commodities and

Treasury Inflation-Protected Securities (TIPS), are expensive and lock in

negative real interest rates. An alternative way to hedge portfolios for

inflation risk is by remaining defensive with duration and active within

commodity-centric credit exposures.

Tighter financial conditions set the stage for greater volatility

As the Fed begins to withdraw liquidity from the financial system,

we will see tighter financial conditions, meaning wider credit spreads

and greater volatility. This leaves risk assets more vulnerable to shocks.

Finding winners and losers as rates increase puts greater emphasis on

research that can distinguish between the two.

Rethinking the role of US Treasuries in asset allocation

We are heading into an environment in which risk assets – like emerging

market bonds and high yield – are both more expensive and more

vulnerable. Picking the right bonds through credit research becomes

essential in this environment. In addition, allocating to US Treasuries,

despite record-low yields, could provide a buffer against potentially

higher equity and credit risk.